Each proposed chapter 13 plan provides how each secured claim is to be handled. This protection limits the contact between the debtor and creditor but allows for mediation.

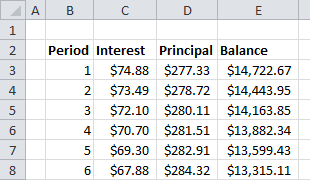

Create A Car Loan Calculator In Excel Using The Sumif Function Part 2

To qualify for a car loan during a Chapter 13 bankruptcy a borrower has to be current on their repayment plan and one year has to have passed since the filing date unless they included any existing auto loan in the bankruptcy.

. Chapter 13 bankruptcy is a form of legal debt relief that can stop automobile repossession and offer you time to reorganize your debt in an effort to pay back your creditors. And as with all car loans you can reduce the interest rate and pay lessyour bankruptcy lawyer will know the current amount. Another outside option would be petitioning the Court to.

Can I Modify my Confirmed Chapter 13 Plan to Surrender a Vehicle Being Paid Inside the Plan. If that were the case then filing for Chapter 13 would be the equivalent of putting on handcuffs for 36-60 months. If the loan modification is built into your bankruptcy filing the lender may be forced to accept the new mortgage payments as part of your three to five year payment plan.

This means that they owe more on the car than the car is worth. Youll continue making your new mortgage. In some cases you may be able to reduce the amount paid to unsecured creditors in order to afford the new car payment.

November 5 2018 Chapter 13. Your attorney may also need to amend your bankruptcy schedules. Please contact your bankruptcy attorney and request a release form allowing the mortgage company to discuss your loan with you.

If you suffered an accident and your income dropped but will return to work at your full salary after six months you might be able to reduce the plan payments to accommodate your lower income then increase. The LMP was developed by the Bankruptcy Law Section of the State Bar of Texas and is adopted to provide a uniform procedure to allow Chapter 13 Debtors Lenders and other parties to negotiate a potential modification of an Eligible Loan. Up to 25 cash back Youll have to present your modification to the bankruptcy judge for approval.

After the trial modification terms have been agreed upon we can help you file. Up to 25 cash back Chapter 13 Plan Modification Isnt Practical People often modify their Chapter 13 plans to lower or increase payments as their income changes. The owners needs to be upside down on the loas.

Effective September 1 2020 the court will adopt a Loan Modification Program LMP. Since you are in an active bankruptcy the bankruptcy code protects you from being contacted by any creditors. Many of my clients who apply for a loan modification dont receive a response until a year after the process began.

Cramdowns are only available in Chapter 13 bankruptcy. Car Loan Modification In Chapter 13 debtors may substantially reduce monthly car loan payments by modifying the car loan either by reducing the loan balance to the fair value of the car extending the time for payments reducing the amount. An alternative to loan modification is to file for bankruptcy to protect your assets.

Reduce Your Car Loan Balance in Chapter 13 Bankruptcy With a Cramdown If you satisfy certain conditionsthe rules vary by stateyou can reduce or cram down the principal balance of your car loan to the cars fair market value. You may also need to modify your Chapter 13 Plan. A Chapter 13 debtor typically pays back only a.

In addition once mortgage arrears are included in the new loan they begin to incur interest so curing 10000 in mortgage arrears could end up costing the debtor 30000 or more over the life of the loan. Chapter 13 Loan Modification Program. More importantly a borrower needs authorization.

One of the major benefits of Chapter 13 Bankruptcy is the ability to avoid second mortgages that are not secured by any value in your home. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. After your Plan has been confirmed by the court you can request a modification of the payment terms if your situation changes.

Put simply the secured part will only be up to the value of your vehicle. In the Northern District of Texas. But before modifying a mortgage loan homeowners should weigh the true cost of refinancing their mortgage and consider curing mortgage arrears in a Chapter 13 bankruptcy case instead.

Most judges will approve the plan if the new terms are reasonable. If a person is otherwise eligible for either a chapter 7 or 13 I usually dont recommend doing a 13 for the sole reason of modifying a car loan. People must have owned the car for at least 910 days.

Ad Board Certified Consumer Bankruptcy Debt Relief Attorney In The Houston Area. The Private Sale Option. Though most modifications are requested by the debtor either the trustee.

The rest becomes unsecured which gets lumped with other unsecured debts like credit card debt. Chapter 13 is the repayment bankruptcy so many borrowers rely on their vehicles to continue working so they can keep up with their repayment plan. Thats simply not the case.

To learn how Chapter 13 bankruptcy and the repayment plan work see the articles in our Chapter 13 Bankruptcy. You may be eligible. You will have lower mortgage payments but extra charges such as a longer period of payback additional interest and new loan costs and fees can add up.

Under Chapter 13 a debtor can separate their car loan into two partsa secured part and an unsecured part. If your car breaks down and you need another to continue getting to and from work so you can keep paying bankruptcy courts are typically understanding. By following standards outlined in the Bankruptcy Code you can reclassify that loan on your home into the same category as credit cards or.

By amending your plan we can restructure the entire plan and make changes as needed. Auto lenders retain their. When Modifying Your Plan May Not Work.

But your plan cant last longer than five years from the date you filed your case. If you have bad credit no credit bankruptcies or even repos were the answer. Foreclosure eliminates the opportunity to.

The general rule is that the plan must propose to pay the value of the. When you file for Chapter 13 bankruptcy you must pay off certain obligations such as priority debts and secured debt arrears on assets you want to keep in full through your repayment plan. Sometimes we can elect to pay the loan through the Chapter 13 plan.

Chapter 13 payment plans generally last from 3 to 6 years based on your gross income. Florida residents who have filed for Chapter 13 bankruptcy might qualify for what is known as a loan cramdown on their car. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Loan modifications are often a long process. Next youll propose a new Chapter 13 payment plan that removes the mortgage arrearages and any other debt included in the new mortgage like past due property taxes. Chapter 13s cost more and theres always the chance that the vehicle wont last or that there are other circumstances where you cant afford it anymore in which case youre probably better off in chapter 7.

This may make it easier for you to make the payments. Chapter 13 bankruptcy can often be paired with your loan modification. Amending your Chapter 13 plan is one of the more common ways to deal with missed payments.

14 Feb Chapter 13 Bankruptcy Time Bomb. To obtain plan confirmation and proceed in chapter 13 the proposal for a secured claim must either be i accepted by the creditor ii to pay the claim in a particular way or iii to give up the property to the creditor. Auto Lenders Retain Secured Status in a Confirmed Chapter 13 Plan Upon Surrender of Vehicle.

Ad At Easy Auto Lenders you pick the terms and we handle the financing. The real cost of the loan modification. Chapter 13 bankruptcy is known as the wage earner bankruptcy.

Once you receive the courts permission you can go car shopping. In a Chapter 13 bankruptcy you propose a repayment plan to pay back your creditors over a three to five year period. What many individuals dont realize when they contact a Elk Grove Bankruptcy Lawyer is that in some cases you can use Chapter 13 bankruptcy to lower.

Some lenders have stepped in to offer open bankruptcy car loans to fill this lending gap. That being said you do need to prove that taking on this new debt. In some instances filing Chapter 13 bankruptcy may be a better alternative to a loan modification.

There are two other requirements for a cramdown.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

550m Santander Car Loan Class Action Website Is Active Top Class Actions

11 Tips On How To Get Approved For A Car Loan Mercedes Benz

Car Loan Should You Go For A Shorter Or Longer Tenure The Financial Express

0 comments

Post a Comment